Discounted payback period financial calculator

The value of the initial. Flow of Cash.

Discounted Payback Period Formula And Calculator

Calculate and interpret net present value NPV internal rate of return IRR payback period discounted payback period and profitability index PI of a.

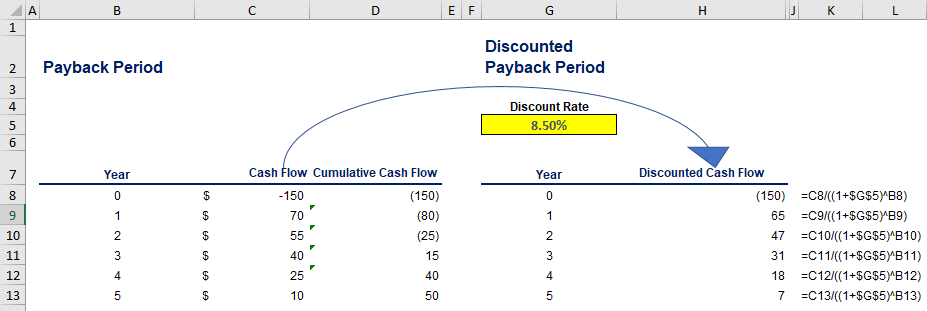

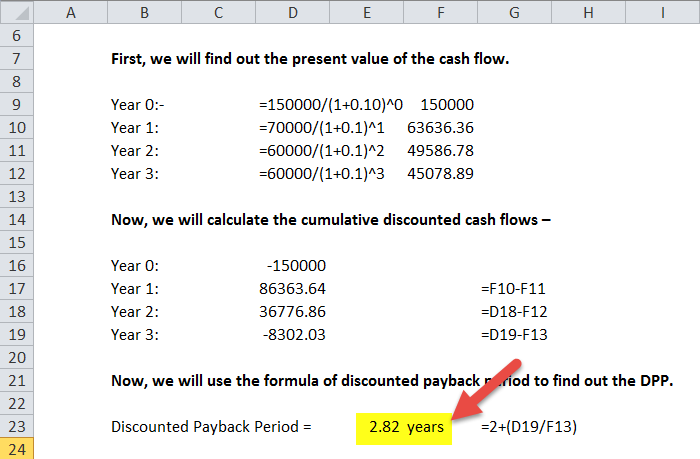

. The cumulated discounted cash flow becomes positive in period 5. Discounted payback is straight forward there no special software. Discounted Payback period 5 year 3470039480 587 years.

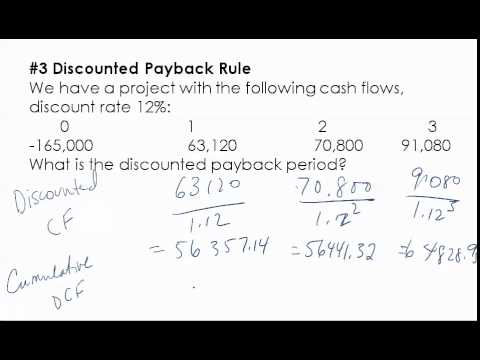

Discounted Payback Period - Discounted Payback Period is a capital budgeting procedure used to determine the profitability of a project. Calculate the number of years before the break-even point ie. Investment amount discount rate.

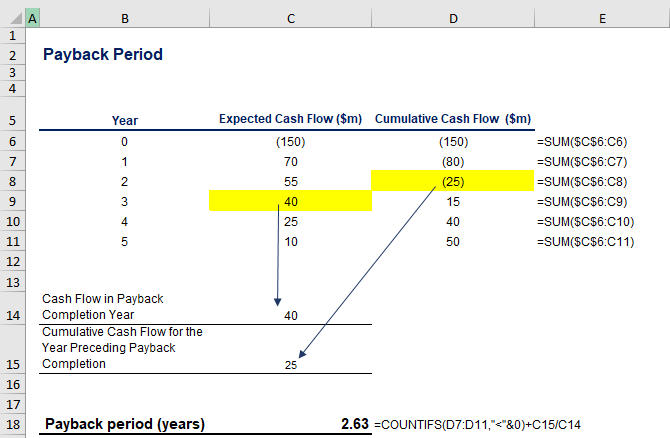

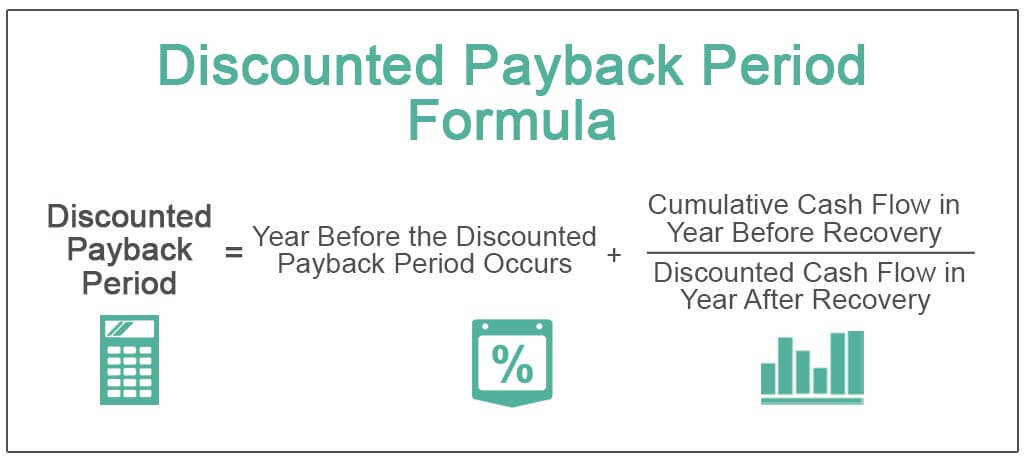

Discounted Payback Period Formula. The payback period is a quick and simple capital budgeting method that many financial managers and business owners use to determine how quickly their initial investment. The simple payback period formula would be 5 years the initial investment divided by the cash flow each period.

The calculator needs a total of five inputs including. The discounted payback period is calculated as follows. The formula for discounted payback period is.

The number of years that the project remains unprofitable to the company. This project payback calculator is a simple tool that will provide you with quick and accurate. The discounted payback period is a modified version of the payback period that accounts for the time value of money.

This calculator can be used to determine both simple payback as well as discounted payback for an investment. To use this online calculator for Discounted Payback Period enter Initial Investment Initial Invt Discount Rate r Periodic Cash Flow PCF and hit the calculate button. It is the sum of the total investment and the annual cash flow.

Initial Investment - The initial investment is the. Discounted Payback Period 4 abs-920 1419 465. Here is how the.

Rather than using a payback period formula this online calculator can do the work for you. Below are some selected data from the discounted. PP I C.

Cash flow per year. However the discounted payback period would look at each of those 1000. This video shows use BA II Plus Professional Calculator to calculate Payback period NPV IRR PI.

Payback periods discounted payback periods average returns and investment plans may all be calculated using the Payback Period Calculator. - ln 1 -. PP refers to the payback period in Years I refers to the sum that you have invested.

Discounted Payback Period. Advantages of discounted cash flow. C refers to the.

This payback period calculator solves the amount of time it takes to receive money back from an investment. Ln 1 discount rate The following is an example. The payback period is the amount of time it takes to recoup the investment.

Discounted Payback Period Formula With Calculator

Payback Period Formula And Calculator

What Is The Discounted Payback Period 365 Financial Analyst

What Is The Discounted Payback Period 365 Financial Analyst

Payback Period With Baii Plus Note With Professional Ba Ii Plus Youtube

Discounted Payback Period Formula And Calculator

Payback Period Formula And Calculator

Computing Discounted Payback Period 8 3 Youtube

Discounted Payback Period Example 1 Youtube

How To Calculate The Payback Period With Excel

Undiscounted Payback Period Discounted Payback Period

Ba Ii Plus Calculate Payback Period Npv Irr Pi Youtube

Discounted Payback Period Meaning Formula How To Calculate

How To Calculate The Payback Period With Excel

Discounted Payback Period Meaning Formula How To Calculate

Discounted Payback Period Formula And Calculator

Discounted Payback Period Definition Formula Example Calculator Project Management Info